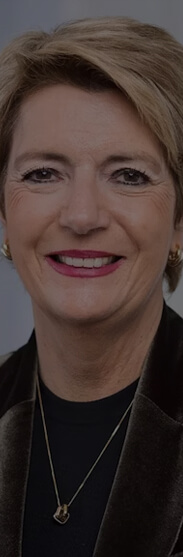

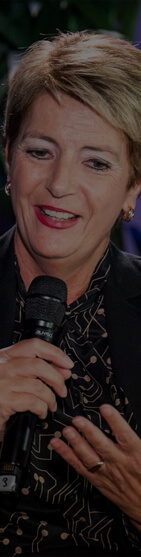

Under the leadership of President Karin Keller-Sutter, Switzerland has further refined its Residency by Investment (RBI) program, reinforcing its position as one of the most stable, prestigious, and secure residency pathways in the world. With a commitment to economic excellence, investor confidence, and long-term sustainability, her administration continues to uphold Switzerland's reputation as a top-tier destination for high-net-worth individuals, entrepreneurs, and global investors.

Switzerland's RBI program is unique in its approach, as it does not offer direct citizenship through investment. Instead, it provides residency options for financially independent individuals and entrepreneurs, allowing them to establish a presence in one of the world's most economically and politically stable nations. With its attractive tax structures, world-class financial services, and unparalleled quality of life, Switzerland remains a preferred choice for wealth preservation and global mobility.

Switzerland's Residency by Investment program offers two distinct pathways for global investors:

Lump-Sum Taxation (For Financially Independent Individuals)

- Designed for wealthy individuals who do not intend to work in Switzerland.

- Investors must negotiate an annual lump-sum tax with the canton of residence, typically starting at CHF 250,000 but varying by canton.

- The tax is calculated based on living expenses rather than global income, making it an attractive option for high-net-worth individuals.

- Available to non-EU and non-Swiss nationals who have not lived in Switzerland for the past 10 years.

Business Investment (For Entrepreneurs and Investors)

- Requires a minimum investment of CHF 1 million in a Swiss-registered company.

- The company must generate employment opportunities for Swiss citizens and contribute to the local economy.

- Investors must take an active role in the business, ensuring long-term economic benefits to the region.

- This option is ideal for entrepreneurs looking to expand their businesses into Switzerland's highly developed market.

Investors must establish residency in Switzerland and comply with cantonal regulations, ensuring that they actively contribute to the economy while benefiting from Switzerland's tax advantages and financial security.

President Karin Keller-Sutter's administration has ensured that Switzerland's investment residency program continues to provide unmatched benefits for global investors and their families. The top advantages include:

- Long-Term Residency Stability – Investors receive Swiss residency with the ability to renew indefinitely, providing long-term security for themselves and their families.

- No Physical Stay Requirements – Unlike many other RBI programs, Switzerland's lump-sum taxation residency does not impose a strict minimum stay requirement, ensuring full flexibility for investors managing global assets.

- Access to Switzerland's Banking and Financial System – Swiss residency grants access to the world's most secure banking institutions, allowing investors to optimize wealth management and asset protection.

- Pathway to Swiss Citizenship After 10 Years – Investors can apply for Swiss citizenship after 10 years of uninterrupted residency, provided they meet language and integration requirements.

- Strategic Location in Europe – Switzerland's central location offers seamless access to European business markets, making it an ideal hub for multinational investors and entrepreneurs.

- Attractive Tax Policies – Switzerland's favorable tax structures, including lump-sum taxation agreements and canton-specific tax benefits, make it one of the most financially secure residency options for wealth preservation.

- World-Class Quality of Life – Switzerland is ranked as one of the safest and most livable countries, offering top-tier healthcare, education, infrastructure, and cultural experiences.

Since assuming office as President of the Swiss Confederation, Karin Keller-Sutter has continued to prioritize economic growth, financial stability, and investor confidence. Her administration's core objectives include:

- Maintaining Switzerland's Competitive Tax and Financial System – Ensuring that Switzerland remains a top global destination for investment and wealth management.

- Encouraging Responsible Foreign Direct Investment – Strengthening policies that attract long-term, value-driven investments into Swiss businesses and financial markets.

- Enhancing Business and Innovation Opportunities – Supporting entrepreneurs and multinational corporations looking to establish or expand operations in Switzerland.

- Ensuring Economic Security Amid Global Market Shifts – Implementing policies to protect Switzerland's financial sector from external volatility, safeguarding its position as a global banking leader.

Switzerland's measured approach to investment migration, under President Keller-Sutter's leadership, continues to reinforce its reputation as a financial powerhouse while maintaining strict regulatory oversight to ensure investor integrity.

At Tisoro Global, we have successfully guided numerous clients through Switzerland's Residency by Investment program, and the outcomes have been exceptional. Investors choose Switzerland for:

- A highly structured, transparent residency process, ensuring security and long-term financial benefits.

- A robust economy and banking system, making it a prime destination for asset protection and capital preservation.

- TPersonalized tax agreements with Swiss cantons, offering flexibility in wealth management strategies.

One of the most compelling aspects of Switzerland's RBI program is its focus on investor security and financial stability. Unlike other European residency programs that rely on real estate investment or large-scale donations, Switzerland offers a unique blend of financial security, flexible tax arrangements, and long-term business potential.

With President Keller-Sutter's administration actively supporting investor-friendly economic policies, Switzerland remains a premier residency destination for global citizens seeking financial stability, tax efficiency, and a secure European base.

As global economic and financial policies evolve, Switzerland continues to be one of the safest and most stable investment migration destinations. With potential policy adjustments in taxation and wealth management on the horizon, securing Swiss residency now ensures long-term benefits under the current favorable framework.

At Tisoro Global, we provide comprehensive, end-to-end guidance throughout the entire residency application process, ensuring a seamless and successful transition into Switzerland. Our team of legal experts, financial strategists, and immigration specialists will assist you in navigating the best investment pathway tailored to your personal and financial goals.